Tax Rebate Check – The rebate check is an excellent method to save money on purchases. However, not many people are aware of how to claim and keep track of the checks. In this direction we’ll provide the reader with a thorough knowledge of rebate checks as well as step-by-step instructions for how to claim them and track the rebates to get the most savings.

What is the Rebate Check?

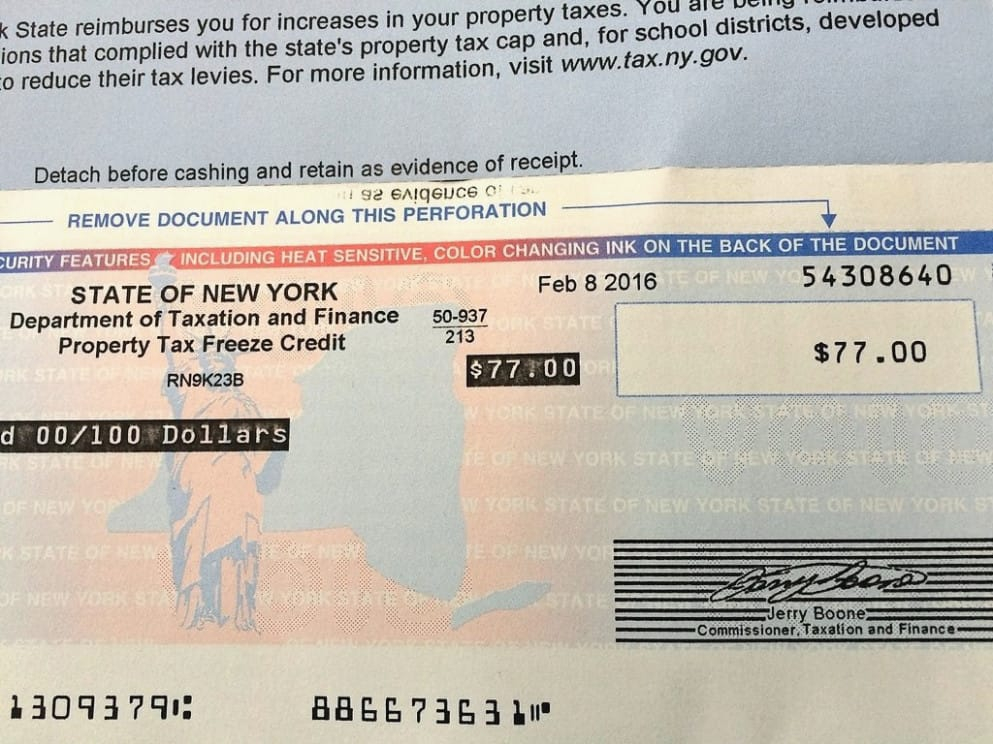

A rebate check is the reimbursement given by manufacturer or retailer as a reward for purchasing the product. It is possible to receive rebates, cash back, discounts on any future purchases or even free items. Rebate checks are usually sent to the client after they have submitted an application with the necessary documentation of purchase, along with any other necessary documentation.

Claim your Rebate. Check

1. Check Eligibility

Before you can apply for your rebate, be sure you’re eligible. Be aware of the terms and phrases of the rebate. They will provide details , such as purchase date and product model.

2. Take the required documents

To claim your rebate you’ll need to gather the necessary documents such as the original receipt as well as the UPC code that is on the package of the product.

3. Submit Your Claim

Once you’ve completed all the necessary documentation, you can make your claim according to the instructions of the manufacturer. This could mean mailing the documents, sending them online, or bringing them to a physical or location.

How can I keep track of my refund?

You can monitor the status of your rebate payment after you’ve filed your claim. To track this go to the manufacturer’s or retailer’s website and enter your tracking number or any other relevant information. This will give you an estimated timeframe for when you should expect to receive your rebate checks.

Tips To Save Money With Rebate Clearance

- Be sure to read the fine print and understand any deadlines or rules that might affect your eligibility to receive a rebate.

- Make copies of all documents submitted in your files for future reference.

- Keep all rebates in order by using a spreadsheet or an app which tracks the rebates.

- You can combine rebates, coupons or loyalty rewards programs to earn additional savings.

Conclusion

Making the right use of rebate checks can lead to significant savings. This guide will help you maximize your savings and make the most of the rebate opportunities. Be organized and read the small of the fine print. Do not hesitate to ask for clarifications or inquiries regarding the terms of rebate. Enjoy saving!