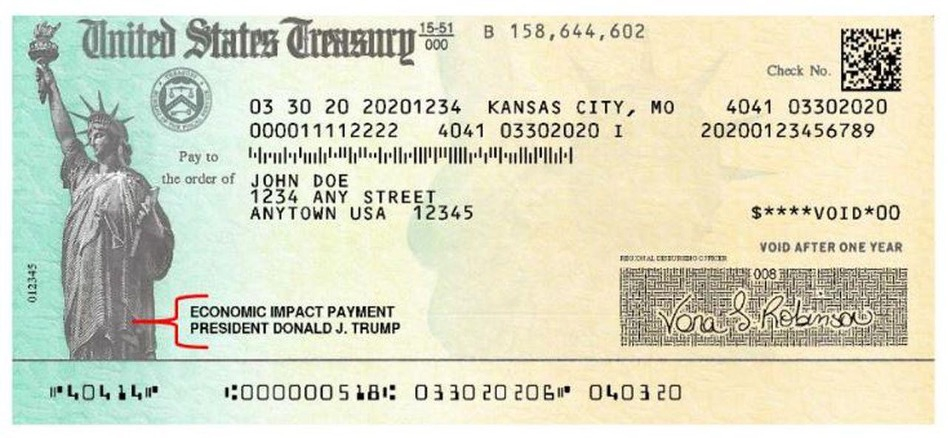

Irs Rebate Checks 2023 – Rebate checks are an excellent option to save money on purchases. However, many do not know how to claim them or how to track their progress. This guide will give you the complete understanding of rebate checks as well as step by guideline on how to claim and track these checks to increase your savings.

What’s a Rebate check?

A rebate check can be an offer of reimbursement from manufacturers or retailers as an incentive to purchase the product. Rebates can be offered in a variety of kinds, like cash back or discounts for future purchases, or even free products. Rebate checks are typically mailed to the client after they have submitted claims with evidence of purchase as well as any other required documentation.

Claim Your Rebate.

1. Check Eligibility

You must confirm that you are eligible before you apply for your rebate. It is important to go through the conditions and terms of the rebate. They will detail the requirements such as the date of purchase, model and any other relevant information.

2. Gather all documents required

In order to claim your rebate, you’ll have to collect the required documents such as the original receipt and the UPC code that is on the product packaging.

3. Submit Your Claim

Once you include all the needed records, you can make a claim following the instructions given by the retailer or manufacturer. This could mean mailing the documents, submitting them online, or bringing them to a physical store at a specific location.

Tracking Your Rebate Check

After submitting your claim, you can monitor the progress of your rebate claim by visiting the manufacturer’s or retailer’s site and entering your tracking number, or any other information pertinent to your claim. This will provide you with an estimate of when the rebate check will be delivered.

Tips To Save Money With Rebate Clearance

- Make sure you have read the fine print, and understand any deadlines or requirements that may apply to the eligibility of rebates.

- Keep an exact copy of all submitted documents for your records, in case any issues arise with your claim.

- It’s possible to utilize a tool for tracking rebates or spreadsheet to help you keep track of your rebates so you don’t lose any rebate offers.

- Look for additional savings opportunities by combining rebates with sales, coupons, or loyalty rewards programs.

Conclusion

Utilizing rebate checks correctly can lead to significant savings. You can make the most of your savings by understanding how to claim and track your rebate payment as well as following the suggestions in this article. Keep organized and always take the time to read the small print. Do not hesitate to ask questions or clarifications concerns regarding rebate terms. Save money!