Irs Check Rebate – Rebate checks are an excellent option to reduce the cost of purchases. However, many people don’t know what to do to claim them, or how to keep track of them. We’ll give you an in-depth understanding of rebate checks as well as step-by step instructions on how you can claim the checks and track the rebates to get the most savings.

What is a Rebate-Check?

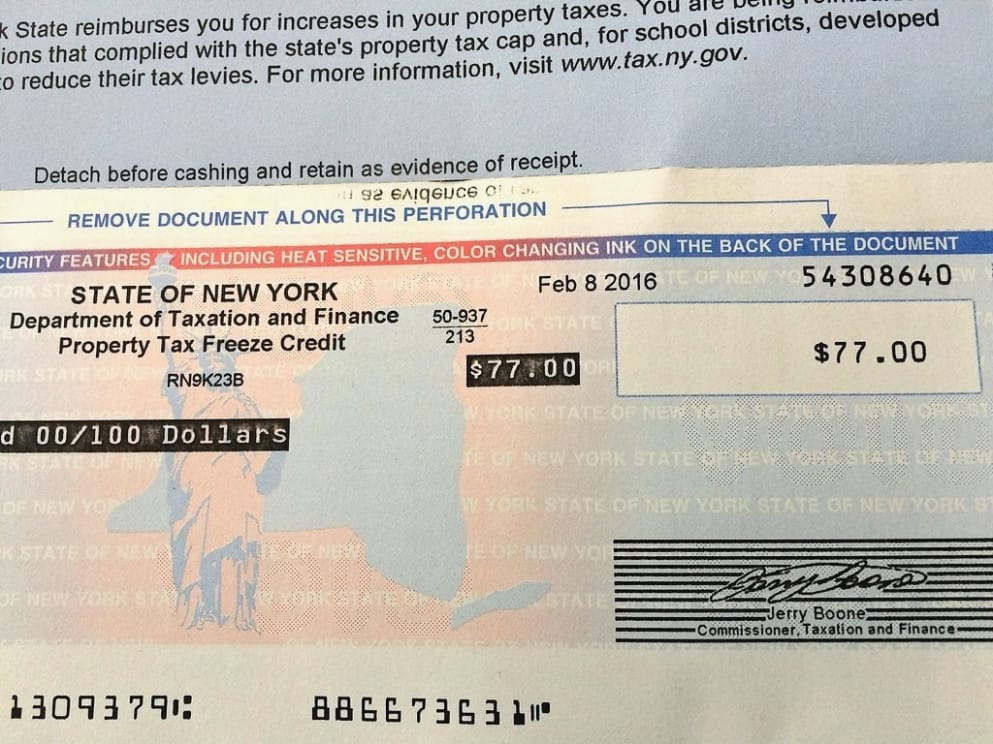

A rebate check can be the reimbursement given by manufacturers or retailers as a reward for purchasing the product. You may receive cash back, discounts on subsequent purchases or even free items. After the customer submits an application, together with the documents required and proof of purchase, rebate cheques are typically sent to them.

How do you claim your Rebate?

1. Check Eligibility

Before you can get your rebate check, ensure that you’ve met the eligibility requirements. It is important to review the conditions and terms of the rebate. They will provide the requirements like purchase date, model of the product and any other relevant information.

2. Take the required documents

To be eligible for the rebate, you need the original receipt along with the UPC barcode (from the package of the product) as well as any other documentation requested by the manufacturer.

3. Submit Your Claim

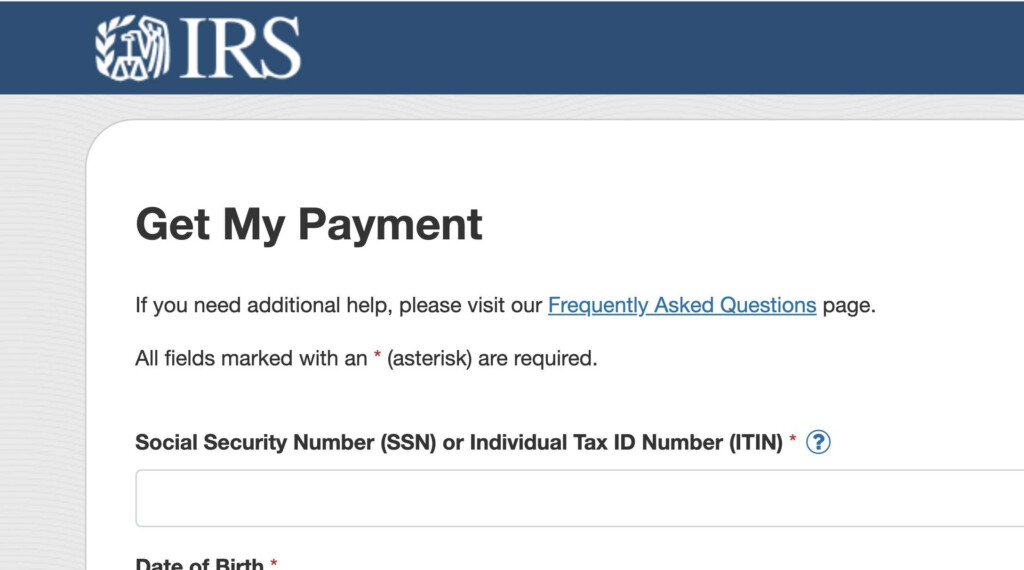

Following the manufacturer or retailer’s instructions, you can submit a claim after you have completed all required documents. This could mean mailing the documents, submitting them online, or bringing them to an actual store location.

Tracking Your Rebate Make sure you check

After you’ve submitted your claim you can monitor the status of your rebate check by visiting the manufacturer’s or retailer’s website , and then enter your tracking number or other pertinent information. This will inform you when you can expect your rebate check to arrive.

Tips to Maximize your savings with Rebate checks

- Be sure to review all terms and conditions.

- Keep copies of all documents submitted to be kept for your records in case any issues arise with the claim.

- It is possible to make use of a rebate tracking tool or spreadsheet to help you stay organized so that you don’t miss any rebate offers.

- Combining rebates with sales coupons or loyalty rewards programs could help you save more.

Conclusion

Checks that are rebated can offer significant savings if they are used in a proper manner. If you can understand the process of claiming your rebate check and track it, and adhere to the tips given in this guide, you will be able to increase your savings. Remember to stay organized and take note of the fine print and never be afraid to inquire or get clarification on the rebate terms and conditions. Enjoy saving!