Internal Revenue Service Utility Rebate Checks Taxable Income – Rebate cheques are an efficient tool you can use to reduce your purchase costs. Many people do not know how to claim them and monitored. This guide will provide you with the complete understanding of rebates along with step by step instructions on how to claim and track these checks to increase your savings.

What is a Refund-Check?

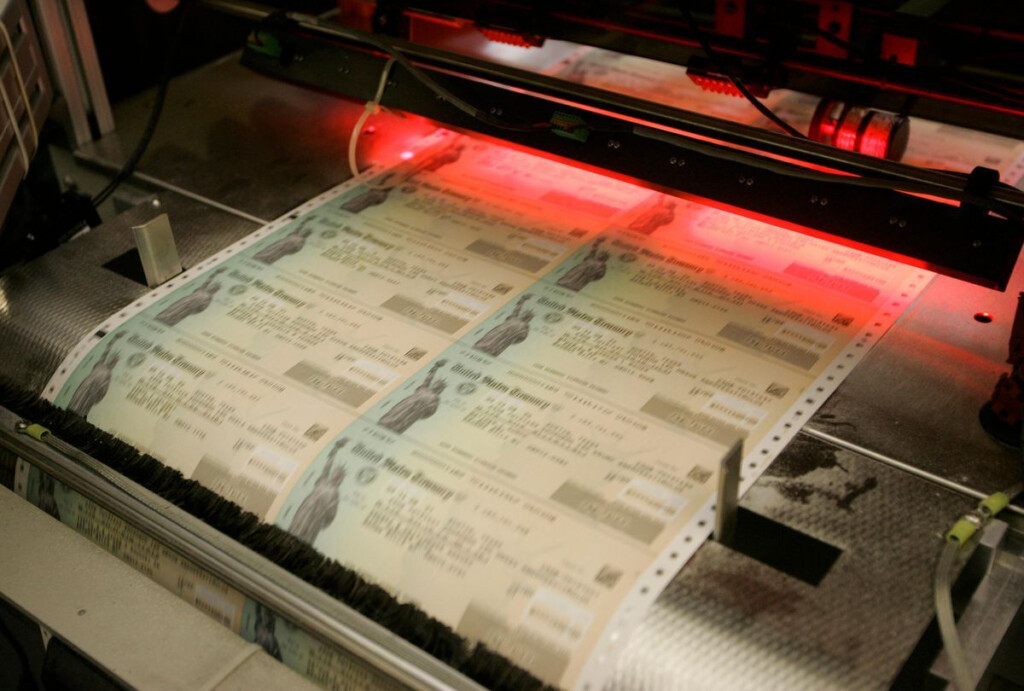

The rebate check is a type of refund that a retailer or manufacturer issues to incentivize buying a product. Rebates are offered in many types, including cash back, discounts for future purchases, or free items. Once the claim is filed with all necessary documentation and proofs of purchases the rebate checks are sent out to the customer.

How Do You Claim your Rebate Check

1. Check Eligibility

Before you can claim your rebate, make sure that you’re qualified. Be sure to carefully go through the conditions and terms of the rebate. They will provide the requirements such as purchase date, model of the product and any other relevant details.

2. Gather all documents required

In order to claim your refund, you will need to gather all necessary documents. These include the original receipt, UPC Barcode from the product packaging, as well the additional documents that might be required by the manufacturer.

3. Submit Your Claim

After you have included all required documentation After you have completed all the necessary paperwork, you are able to file your claim in accordance with the directions of the manufacturer. It may involve sending the documents via post or uploading them online or going to a physical location for retail.

How to Track your Rebate Check

You can monitor the status of your rebate payment after you’ve filed your claim. To track the status of your rebate go to the manufacturer’s or retailer’s website and enter your tracking number or any other information pertinent to the claim. This will provide you with an estimate of when the rebate check will be delivered.

Tips to maximize your savings with Rebate Checks

- Check the fine print with care and make sure you are aware of deadlines and requirements to be eligible to receive rebates.

- Keep copies of all submitted documents in your files for reference in the future.

- You might want to utilize a tool for tracking rebates or spreadsheet to help keep track of your rebates so you don’t lose any rebate offers.

- Combine rebates, coupons, sales, loyalty rewards, and many other promotions to save even more.

Conclusion

Checks for rebates can yield substantial savings if used properly. Learning how to claim and track rebate checks and following these tips can help you maximize your savings. Make sure you are organized and have read the terms and conditions. Do not hesitate to inquire about rebates. Happy saving!