Irs.gov Rebate Check – Rebate checks are an excellent option to reduce the cost of purchases. However, many aren’t sure how to claim them or how to track their progress. In this direction we’ll provide you with an extensive understanding of rebate checks, as well as step-by-step instructions on how to claim and monitor for the best savings.

What does a RebateCheck look like?

The term “reward” refers to a check that is issued by a company or retailer to encourage customers to purchase the product. There are numerous options for rebates, such as cash back, future discounts and even free items. Rebate checks are usually sent to the customer after they have submitted the claim with proof of purchase and other documents.

Check to Claim Your Rebate

1. Check Eligibility

Before you can apply for your rebate check it is essential to confirm that you are eligible to receive the rebate offer. Take time to study the terms and circumstances of the rebate, which will define the specific requirements for the rebate, including the date of purchase, the product model, as well as any other relevant information.

2. Take the necessary documents

To claim your rebate, you’ll have to get the required documents such as the original receipt and the UPC code from the product packaging.

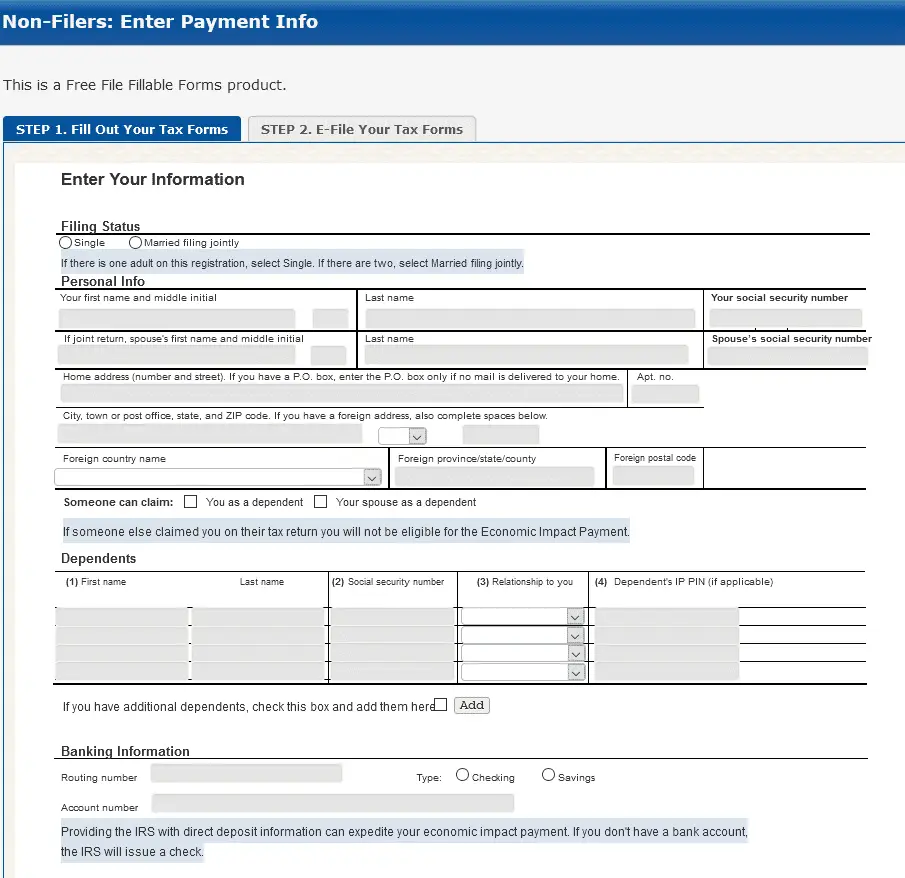

3. Submit Your Claim

Once you include all the necessary documents, you may make a claim following the directions provided by the retailer or manufacturer. This can include sending the documents via mail or online submission, or physically bringing them to a store.

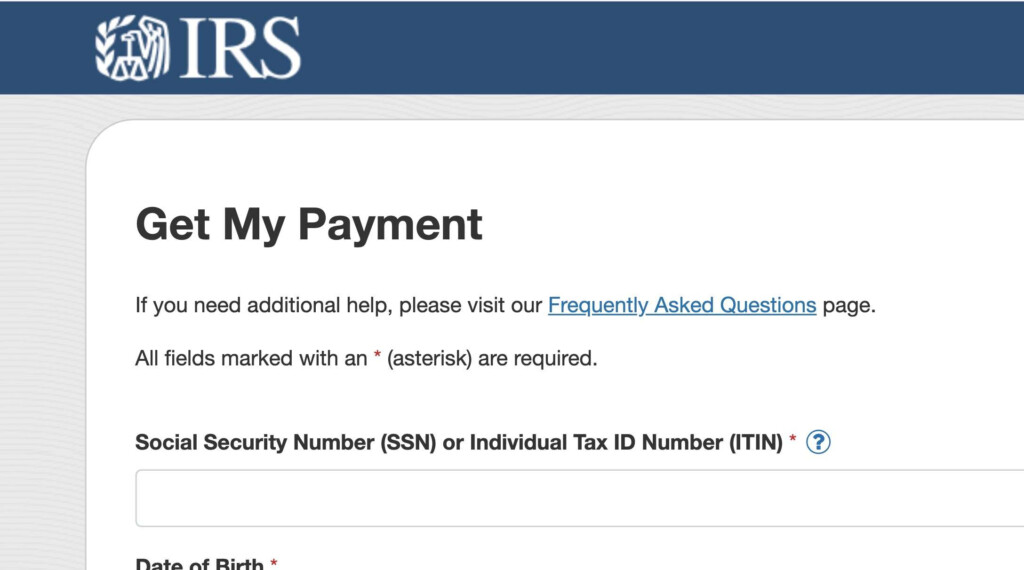

Tracking Your Rebate Pay attention

You can check your rebate check status by visiting the retailer or the manufacturer’s site. Input your tracking number as well as other relevant information. This will give an estimate of the time it will take to get your rebate.

Tips to Maximize Savings with Rebate Checks

- Check the fine print carefully and ensure you are aware of deadlines and conditions to be eligible for rebate eligibility.

- Keep a copy for your records of any documents you submit.

- Keep all rebates in order by using a spreadsheet or an app that tracks them.

- Combine rebates, coupons, sales, loyalty rewards and many other promotions to make savings even greater.

Conclusion

If you utilize rebate checks correctly You can enjoy significant savings. If you are able to comprehend the process of claiming your rebate check and track it, and adhere to the suggestions in this article, you’ll be able to increase your savings. Stay organized, make sure you are aware of all the terms and conditions. Have fun saving!