Rebate Checks From Irs – Checks for rebates are a fantastic method to save money on purchases. However, many people don’t know what to do to claim them, or how to keep track of the rebates. In this regard we’ll provide the reader with a thorough understanding of rebate checks along with step-by-step directions for how to claim them and keep track of them to maximize your savings.

What does a RebateCheck look like?

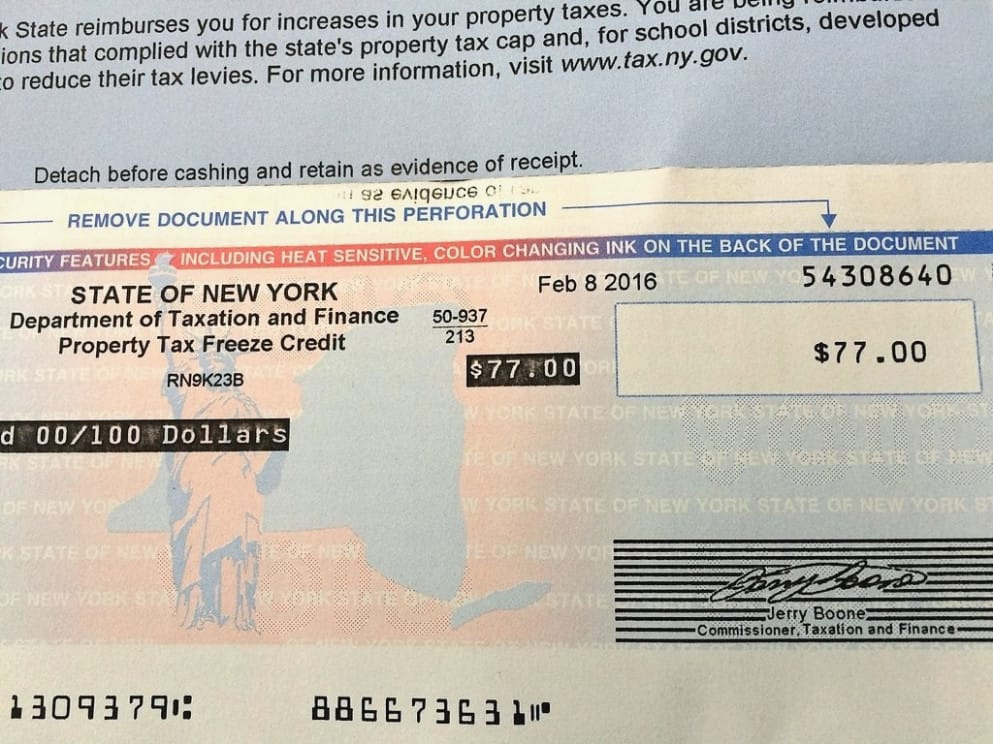

The term “reward” refers to a check issued by a manufacturer, retailer, or both as an incentive to buy a particular product. Rebates may be as cash back or discounts on subsequent purchases. Once the customer has filed a claim and presented proof of purchase, as well as any other documentation, the rebate check will be mailed to him.

How to Claim your Rebate Check

1. Check Eligibility

Before you claim your rebate, make sure that you’re eligible. Pay attention to the conditions and terms of the rebate. They will provide details such as the purchase date and the model of the product.

2. Collect the Documents You Need

In order to claim your rebate you’ll need to collect the required documents such as the original receipt as well as the UPC code from the packaging of the product.

3. Submit Your Claim

After you’ve gathered all the necessary documentation Once you’ve completed the required documentation, you’re able to file your claim in accordance with the instructions of the manufacturer. You can send the documents via mail or online submission, or physically bringing them to a store.

Track Your Rebate. Review

You can track the status your rebate check after you’ve filed your claim. To track this go to the manufacturer’s or retailer’s website, and then enter your tracking number or any other pertinent information. This will provide you with an estimate of when the rebate check will be delivered.

Tips to Maximize your Savings from RebateChecks

- Make sure you have read the fine print and be aware of any deadlines or rules that might affect your eligibility to receive an amount of money.

- Keep a record of all documents submitted for your records in the event there is any issue in your claim.

- It is possible to use a rebate-tracking tool or spreadsheet to help you keep track of your rebates so you don’t lose any rebates.

- Take advantage of extra savings when you combine rebates coupons, loyalty rewards or sales.

Conclusion

Rebate checks can provide significant savings if they are used in a proper manner. By understanding the process of the process of claiming and tracking your rebate check, and implementing the tips provided in this guide will allow you to maximize your savings and make the most of rebate opportunities. Be organized and read the small of the fine print. Don’t be afraid to ask for clarifications or inquiries regarding the terms of rebate. Take advantage of your savings!